MI Request for Land Contract Status free printable template

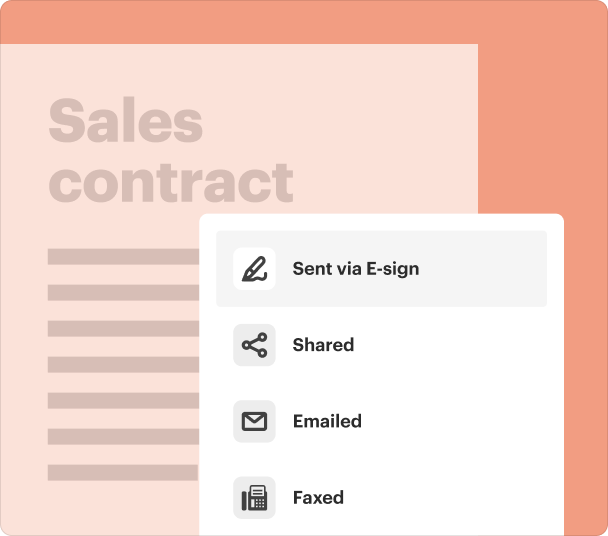

Fill out, sign, and share forms from a single PDF platform

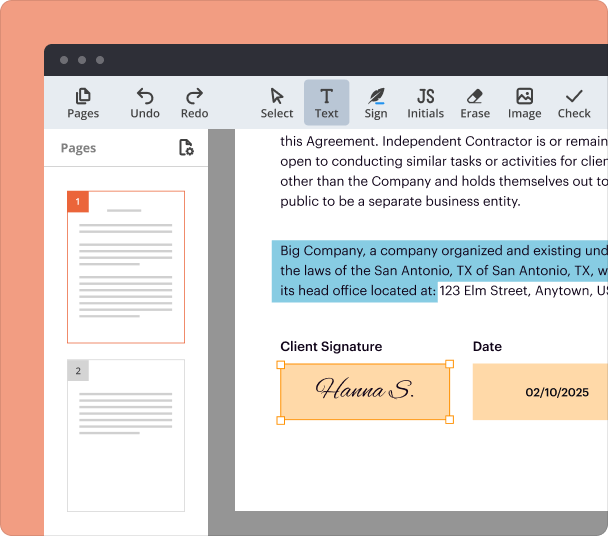

Edit and sign in one place

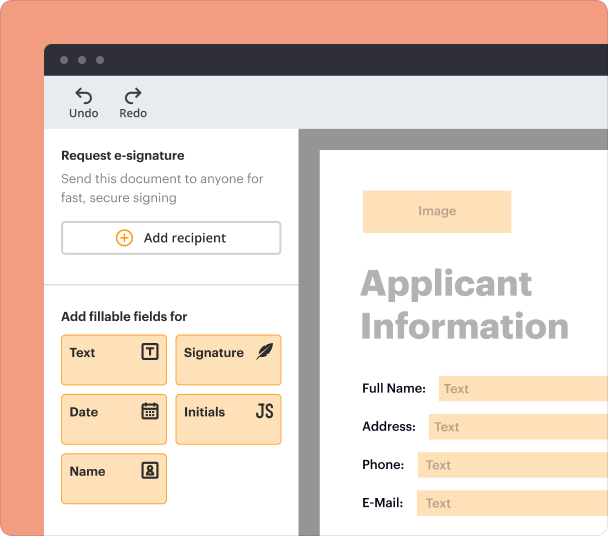

Create professional forms

Simplify data collection

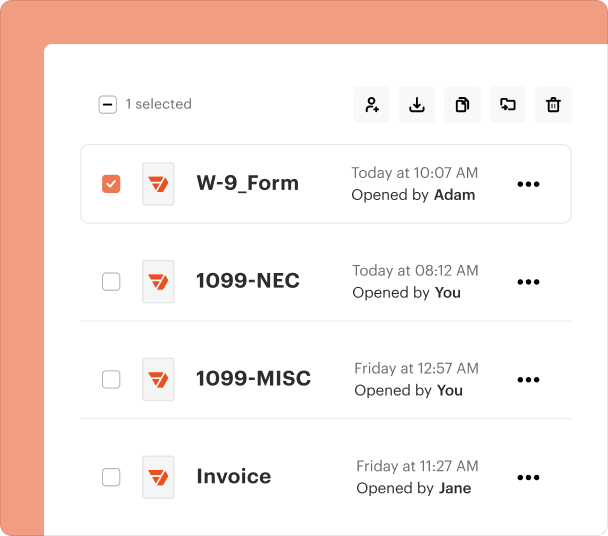

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

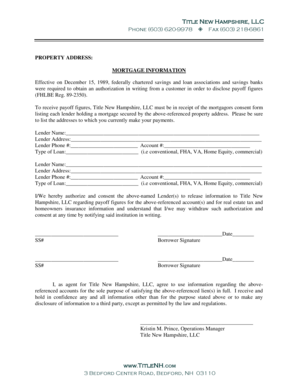

Understanding the Request for Land Form

What is the Request for Land Form?

The MI Request for Land Form is a legal document used to formally inquire about the status of a land contract. This form typically requests details such as the remaining balance owed on the land contract, the original sales price, interest rate, and payment schedule. It is essential for parties involved in a land contract to understand their obligations and current financial status.

Key Features of the Request for Land Form

Key features of the MI Request for Land Form include:

-

The form requests specific financial details, ensuring transparency between buyer and seller.

-

Dated submissions serve as an official record, vital for both parties in case of disputes.

-

The layout simplifies information gathering, making it straightforward to complete.

When to Use the Request for Land Form

This form should be utilized when a purchaser or seller requires clarification on the financial terms of a land contract. Common scenarios include preparing for a property transfer, assessing remaining debt before refinancing, or resolving disputes over payment history.

How to Fill the Request for Land Form

Completing the MI Request for Land Form involves the following steps:

-

Include your name and contact details to establish your identity as either the seller or purchaser.

-

Clearly state the property address associated with the land contract to prevent confusion.

-

Include original sales price, interest rate, payment due dates, and the date of the last payment.

-

Clearly articulate what information you seek regarding the remaining balance.

Common Errors and Troubleshooting

Common issues when filling out the MI Request for Land Form include:

-

Ensure all necessary fields are filled to avoid processing delays.

-

Double-check that the property address matches official records to ensure accuracy.

-

Both parties' signatures are required; verify that all necessary signatures are included.

Benefits of Using the Request for Land Form

Utilizing the MI Request for Land Form offers several advantages:

-

Having accurate financial information allows both parties to make informed decisions regarding the land contract.

-

The clarity provided by the form helps prevent misunderstandings between buyers and sellers.

-

A well-documented request can expedite the land contract process, leading to quicker resolutions.

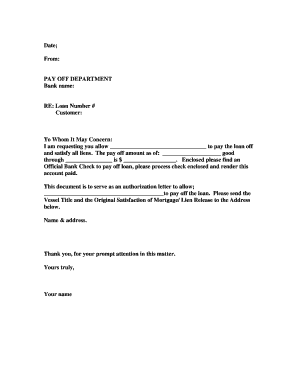

Frequently Asked Questions about land contract payoff letter form

Who can fill out the MI Request for Land Form?

Both sellers and purchasers involved in a land contract can complete this form to request information about the contract status.

Is there a charge for using the MI Request for Land Form?

Generally, there should not be any charges associated with requesting information via the MI Request for Land Form unless specified by the seller or lender.

pdfFiller scores top ratings on review platforms